Ah, money. Work for it, then spend it on life. Some people try to keep track of the flow of funds, both to have enough to make it until the next influx of cash and to build habits of saving. Others let it slip through their fingers without attempting management. Developing habits to keep track of your money, no matter how much you think you have, will help avoid unnecessary crisis and dependence on others. It will also help you enjoy life more! A book-style register or ledger can be very useful for this.

The system I use for my bank account register comes very close to exactly listing all our purchases. It is not quite as detailed as an item by item budget evaluation. It does help tie together all of our cash flow in ways that keep me aware of how much is being spent for what. This includes credit cards and savings account. It has evolved through raising 7 children and helping to put them through college.

We have, over the years, occasionally kept a receipt by receipt record of all spending. It takes dedication. Just doing it every few years can really help, even if you never add up the receipts and do a complete final calculation. Somehow it helps prepare the mind and refine techniques for semi-detailed routine record keeping. But it is very time consuming and does not work well for me in everyday life.

The ledger books that I have been using for a few years came from Walmart. I just realized that I needed a new one and they were out of stock, so I found an Account Book on amazon.com that I think I will like a bit better. It has one more column so I can keep debits and credits listed separately.

To begin with, I enter just about everything in the ledger (sometimes also referred to as my checkbook register, even though it is more inclusive than that). Credit card purchases are deducted at the time of purchase, so there are no surprises when the bill comes. The money has already been counted as spent. Because many things ordered online tend to be shipped in creative combinations, I list each item singly in the register. That makes it easier to keep track of when the billing statement comes or it is time to balance everything.

Each entry gets a designation for how the transaction occurred. Specific credit card? Transfer between accounts? Electronic bill pay or old-fashioned check? This can be more important than the exact date when it comes to balancing accounts.

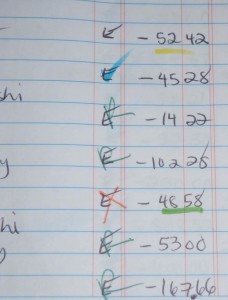

Then, when a credit card statement comes, I double check that each charge is actually in the register. At the same time, I color code the entry. This makes it less time consuming to find them all again when I have to go back and look.

An entry gets a category label that is the same as what I enter in the computer. Call me paranoid, but having had computer failures and electrical outages, there is nothing like a hard copy of our financial resources. On the other hand, the computer program makes balancing much easier. I use CheckBook Pro. I used to use Quicken, but when I got a new Mac computer it was not available. CheckBook Pro has turned out to be simpler anyway, and has a stellar technical support staff.

The category labels can be as specific or broad as is useful. I have a sub-category for fuel for each vehicle. I distinguish between essential food and party food most of the time. I don’t separate out regular household paper and cleaning supplies from groceries, though. I list medical costs by person because this helps to track bill payment. However, costs for regular music or language lessons are very standard, so I don’t worry about tracking all payments for them.

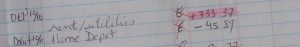

When I have entered each item in the computer, an “E” goes in a small column next to the amount. At balancing time, when I am checking to see if transactions on the statement match those in my written register and on my computer, I rotate the symbols ✓, C, R, and X between statements, to make it easier to see what goes with what. (see photo above to the right) I also try to use different colors for visual aid. It makes it easier to go back through things and know which ones I should be checking when there is a discrepancy.

Even when I have had 2 different columns for debit and credit (deposit), I have found it useful to highlight deposits. I always use the same color for this, so there is no guessing. I don’t use that color quite the same way for anything else. (I use pink, because I can) This makes it extra easy to find the (unfortunately) more spaced deposits. It also provides a double check that I have entered the deposit correctly. Finding that a debit is really a credit may be fun at balancing time, but it can bring a lot of stress during the rest of the time when you might think you are short on funds!

I like to leave the left side page free of entries. Somehow it is easier to keep track of things with only one page to look at. I use the “blank” page for notes, math, and other reminders.

If it helps, think of all of this as a secret personal code system. Or a game where you get extra points for keeping track of things. Because, really, you do! Having a good way to monitor your expenditures and cash flow is am important step toward controlled spending. 🙂

Leave a Reply